Preparing for a Recession: Insights from Historical Data and Rebound History

As economic cycles are inevitable, individuals and businesses must be prepared for a potential recession. As a global pandemic continues ravaging economies worldwide, many experts warn of a looming recession. A recession is defined as a period of decline in economic activity, typically characterized by a drop in GDP, a decrease in consumer spending, and an increase in unemployment.

However, predicting the timing and severity of a recession can be challenging. Fortunately, we can learn from historical data and rebound history to gain insights into how to prepare for a recession. We can identify patterns and strategies to help weather economic downturns by examining past recessions and recoveries.

This guide will explore the lessons we can learn from historical data and rebound history and provide practical tips for preparing for a potential recession. Whether you are an individual or a business owner, understanding how to prepare for a recession can help you minimize the impact of an economic downturn and emerge stronger on the other side. The connection between the 2023 recession, inflation, and government stimuli is crucial when preparing for a potential economic downturn.

Historical Data on Recessions

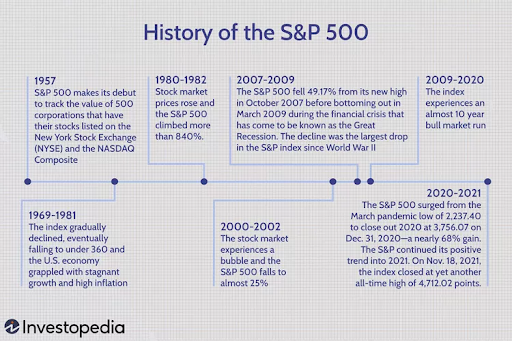

Over the past century, the United States has experienced several recessions, the most recent being the Great Recession that began in 2007 and lasted for 18 months. According to data from the National Bureau of Economic Research (NBER), there have been 33 recessions in the US since 1854, with an average duration of just over a year. The causes of these recessions have varied, ranging from financial crises to external shocks, such as wars or pandemics.

However, one common factor in these recessions is decreased consumer spending. This can be due to a decrease in disposable income, a decrease in consumer confidence, or an increase in the cost of goods and services. In previous recessions, the decline in consumer spending has often been accompanied by a decrease in business investment, as businesses cut back on spending in response to declining sales.

The most prolonged and severe recession in US history was the Great Depression, which began in 1929 and lasted for more than a decade. This recession was caused by a combination of factors, including the stock market crash of 1929, bank failures, and a decrease in international trade. The Great Depression profoundly impacted the US economy and society, with high levels of unemployment and poverty and a lasting legacy of government intervention and economic reform.

Despite the severity of the Great Depression, the US economy has rebounded from every recession it has faced. In fact, some economists argue that recessions can be a necessary part of the economic cycle, as they can help to reallocate resources and spur innovation. By understanding the historical data on recessions and the factors that have contributed to their onset and recovery, we can gain valuable insights into preparing for and navigating through a potential future recession.

Rebound History after Recessions

While recessions can be challenging, they are often followed by periods of growth and recovery. According to data from the Bureau of Labor Statistics, unemployment rates tend to decline following recessions as new jobs are created, and businesses begin to reinvest. This is because, during a recession, many companies cut back on their spending, including hiring and investment, in order to weather the economic downturn. However, as the economy begins to recover, businesses may start to hire again and invest in new projects, which can contribute to a rebound in economic growth.

One of the most notable examples of this was the Great Recession of 2008, which was followed by a period of strong economic growth. In the aftermath of the recession, the US government implemented several policies designed to stimulate the economy, such as the American Recovery and Reinvestment Act of 2009. Between 2009 and 2014, the US economy grew by an average of 2.2% per year, with unemployment rates declining from 9.3% to 5.6%. The stock market also experienced a significant recovery, with the S&P 500 index increasing by more than 150% between March 2009 and September 2014.

While the recovery from the Great Recession was robust, not all recessions have experienced such strong rebounds. For example, the recovery from the 2001 recession was slower and more gradual, with unemployment rates remaining high for several years.

Various factors, including the severity of the recession, government policies, and global economic conditions can influence the length and strength of the recovery following a recession. Despite the challenges of a recession, history has shown that the economy can recover and thrive in the long term. By understanding the rebound history after past recessions and the factors that contributed to the recovery, individuals and businesses can gain valuable insights into how to navigate through a potential recession and position themselves for future growth.

Tips for Preparing for a Recession

A recession can be challenging for individuals and families, with potentially negative impacts on employment, income, and investments. So, it is essential to train yourself in financial literacy, protection planning, business planning, and investment management. However, taking proactive steps can help mitigate the effects of a recession and protect your financial stability. These tips are designed to help you prepare for a potential economic downturn so that you can weather the storm with greater ease and confidence. While no one can predict when a recession will occur, being prepared and taking action now can help you to feel more secure and in control of your financial future.

Build an emergency fund: A rainy-day fund can help weather financial storms, such as a recession. Aim to save at least six months' worth of expenses in an emergency fund, so you can cover your bills even if you lose your job.

Reduce debt: High debt levels can make it more difficult to weather a recession. Try to pay off your debts, or at least reduce them, to have more financial flexibility.

Consider diversifying your investments: If you have investments, consider diversifying your portfolio to reduce your exposure to a single sector or market. This can help to mitigate the impact of a recession.

Stay informed: Stay informed about economic trends and the latest news on the economy. This can help you to make informed decisions about your finances and investments.

Conclusion

In conclusion, preparing for a recession is essential to protecting your financial well-being. While the prospect of an economic downturn can be daunting, taking proactive measures such as building an emergency fund, reducing debt, diversifying investments, and staying informed about economic trends, can help you to weather the storm and come out on the other side with more excellent financial stability.

Remember, a recession is often followed by periods of growth and recovery, and with the right preparation and mindset, you can position yourself to take advantage of the opportunities that come with an economic upturn. You can help ensure a stronger financial future for yourself and your loved ones by taking action to prepare for a potential recession.